SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| Stanley Black & Decker, Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

| STANLEY BLACK & DECKER, INC. |

March 9, 20186, 2019

Dear Fellow Shareholder:

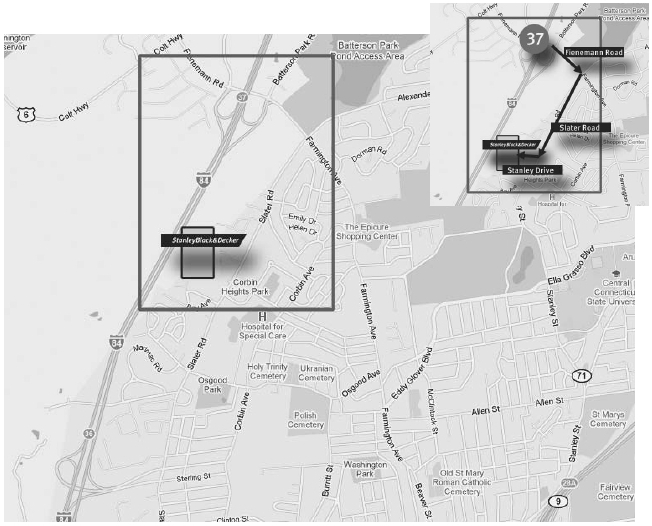

You are cordially invited to attend the Annual Meeting of Shareholders of Stanley Black & Decker, Inc. (“Stanley Black & Decker” or the “Company”) to be held at 9:30 a.m. on April 19, 2018,17, 2019, at the John F. Lundgren Center for Learning and Development, 1000 Stanley Drive, New Britain, Connecticut 06053 (see directions at the end of this document).

This document includes the Notice of Annual Meeting of Shareholders, a letter from the Chairman of our Board of Directors and the Proxy Statement. The Proxy Statement describes the business to be conducted at the Annual Meeting and provides other important information about the Company that you should be aware of when you vote your shares.

The Board appreciatesIn our 2018 letter to our shareholders, which is included in our Annual Report, we describe our vision and encouragespurpose, strategic initiatives and our financial performance. We are committed to providing our shareholders with long-term value, and we hope that you will find the letter informative. I would like to personally thank you for your continued investment in our Company.

We appreciate and encourage your participation. Whether or not you plan to attend the meeting, ityour vote is important to us and we hope that your shares will be represented.PLEASE REGISTER YOUR VOTE BY TELEPHONE OR ON THE INTERNET, OR RETURN A PROPERLY COMPLETED PROXY CARD, AT YOUR EARLIEST CONVENIENCE.

Very truly yours, | |

| |

| |

| James M. Loree | |

| President and Chief Executive Officer |

| Letter to Shareholders from the Chairman of our Board |

Dear Fellow Shareholder:

Thank you for your investment in Stanley Black & Decker, Inc. In advance of our 2019 Annual Meeting, I wanted to share with you some highlights of the Board’s work during the past year.

Oversight of Company Strategy and Risk

My fellow directors and I believe that one of our most important responsibilities is providing independent oversight of the Company’s short- and long-term business strategy, and at nearly every Board meeting, we discuss progress on management’s execution of the strategy and our commitment to our 22/22 Vision. To assist in our review of the Company’s strategy to achieve long-term value creation, we recently devoted our October 2018 meeting to engaging with senior management and high potential leaders regarding their strategic plans for the next three years. We also pay close attention to enterprise risks, including risks related to culture, human capital and conduct, and oversee the calibration of those risks to maximize the long-term interests of the Company.

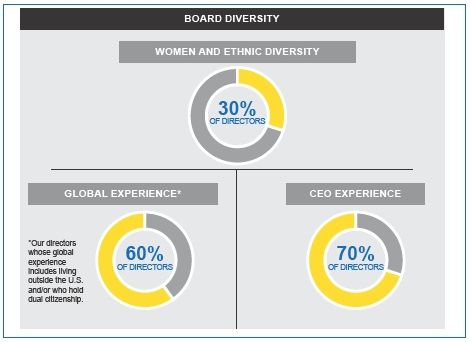

Board Composition and Diversity

The Board is collaborative and represents a variety of experiences and viewpoints, enabling us to have informed, frank and objective discussions. Through the Board’s annual self-evaluation process, we pay careful attention to Board composition in order to ensure that we have the right mix of skills, experience and perspectives to oversee the rapidly changing business dynamics and environment in which the Company operates. Over the last three years, we have added three independent directors who are leaders in their fields, balancing their fresh perspectives with the deep institutional knowledge of our more tenured directors. Most recently, in July 2018, we welcomed Dmitri Stockton to the Board. Mr. Stockton is the former Chairman, President and Chief Executive Officer of GE Asset Management. This year, Robert Ryan and Marianne Parrs are retiring from the Board and will not be seeking re-election. We thank them for their significant contributions and many years of service to the Board and our shareholders.

The Board has also focused on refreshing its Committee leadership and has elected Andrea Ayers as the Chair of the Compensation and Talent Development Committee; Patrick Campbell as Chair of the Audit Committee; and Michael Hankin as Chair of the Finance and Pension Committee.

The Board is committed to diversity and inclusion on the Board and throughout the Company. In July 2018, the Board amended the charter of the Corporate Governance Committee to formally confirm our commitment to considering diversity in the process of identifying director candidates.

Corporate Social Responsibility

The Board is directly involved in the oversight of the Company’s corporate social responsibility initiatives. To formalize this oversight role, in July 2018, the Board amended the charter of the Corporate Governance Committee to include responsibility for reviewing the Company’s policies, objectives and practices regarding environmental management, sustainability and corporate social responsibility. The Company has enhanced its communications and disclosures regarding these efforts so that shareholders can better understand how the Company’s corporate social responsibility strategy is integrally tied to business strategy and long-term value creation.

Corporate Governance

The Board understands its responsibility for good governance and strives to make governance changes that align with evolving best practices. For example, in July 2018, we voted to amend the Company’s Bylaws to proactively adopt proxy access, which enables eligible shareholders to nominate candidates for our Board to be included in our proxy statement.

Shareholder Engagement

Because accountability to shareholders is critical to our success, we have developed a broad engagement process to gather year-round feedback and insight from our shareholders. During 2018, we reached out to shareholders representing approximately 43% of our shares outstanding and engaged on topics including board composition and structure, risk management, sustainability, innovation and strategy, as well as our executive compensation program. The Board has incorporated valuable insights from this engagement into its deliberations, and we look forward to continuing our dialogue with our shareholders.

My fellow directors and I value your ongoing support of the Company and thank you for the confidence you have placed in us.

| Sincerely, | |

| |

| George W. Buckley | |

| Chairman |

WHO WE ARE AND HOW WE OPERATE

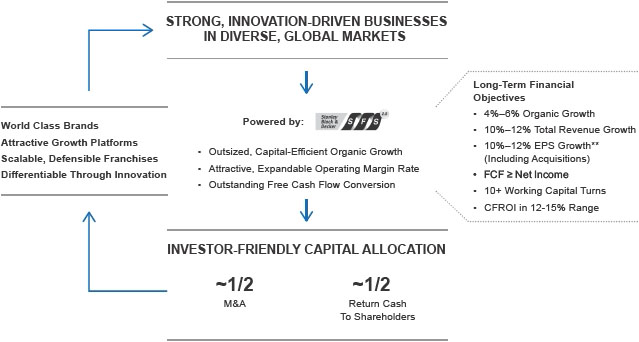

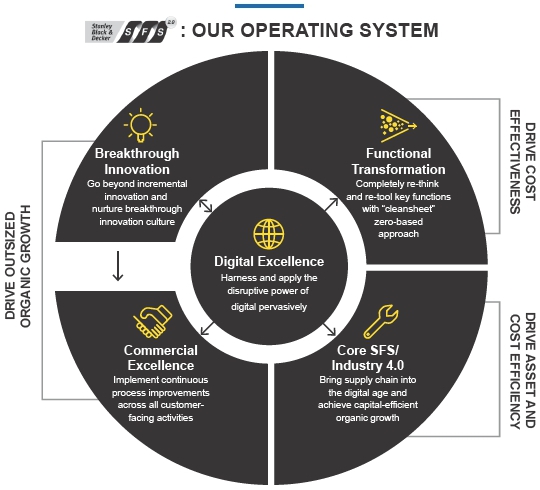

Stanley Black & Decker, an S&P 500 company, was founded over 175 years ago, and is a diversified global provider of hand tools, power tools and related accessories, engineered fastening systems and products, services and equipment for oil & gas and infrastructure applications, commercial electronic security and monitoring systems, healthcare solutions, and mechanical access solutions (primarily automatic doors). We are the worldwide leader in tools and storage. We work every day to create the tools that help build and maintain the world. The Company continues to execute a growth and acquisition strategy that involves industry, geographic and customer diversification to foster sustainable revenue, earnings and cash flow growth. The Company remains focused on organic growth, including increasing its presence in emerging markets, and leveraging the STANLEY Fulfillment System (“SFS 2.0”), which focuses on digital excellence, commercial excellence, breakthrough innovation, core SFS operating principles, and functional transformation. In addition, the Company continues to make strides towards achieving its 22/22 Vision of reaching $22 billion in revenue by 2022 while expanding the margin rate, by becoming known as one of the world’s leading innovators, delivering top-quartile financial performance and elevating its commitment to social responsibility.

SFS 2.0 is our operating system and engine for continuous improvement, helping our people drive operational excellence across the business. SFS 2.0 brings a next-generation focus on driving breakthrough innovation, digital excellence, commercial excellence and functional transformation, seeking step-change impact in how we perform as a leading global industrial company.

SFS 2.0: The Evolution of Excellence

| OUR VALUE CREATION MODEL |

| WORLD CLASS BRANDED FRANCHISES WITH SUSTAINABLE STRATEGIC CHARACTERISTICS THAT CREATE EXCEPTIONAL SHAREHOLDER VALUE |

| ** | 7%-9% excluding acquisitions | Excludes M&A related charges |

i

KEY BUSINESS PERFORMANCE HIGHLIGHTS

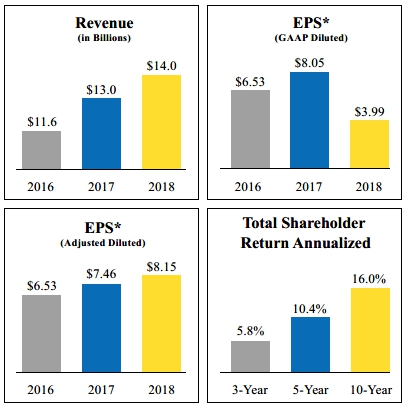

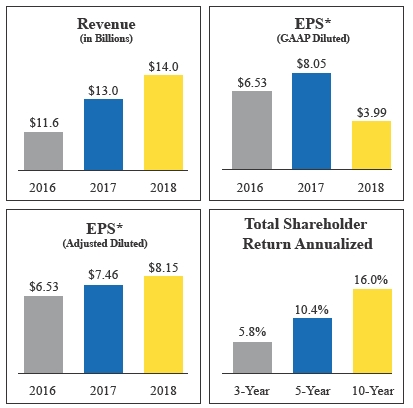

During 2018, we continued to make significant progress against our strategic priorities:

| ● | Total revenue was $14.0 billion, up 8% versus the prior year, with 5% organic growth.* |

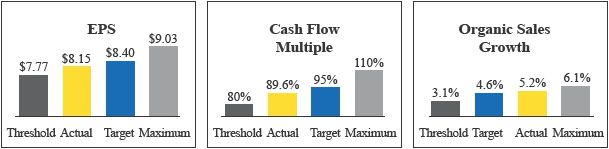

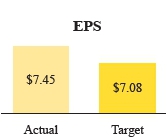

| ● | The Company’s GAAP diluted EPS was $3.99 compared to $8.05 in 2017. Both periods included acquisition-related and other charges and 2017 included a gain from the divestiture of the majority of the mechanical security business. Excluding these amounts, adjusted diluted EPS was $8.15 in 2018 versus $7.46 in 2017. Despite absorbing approximately $370 million in external headwinds from commodity inflation, foreign currency and new tariffs, the Company was able to achieve adjusted diluted EPS growth of 9% versus the prior year.** |

| ● | Other key long-term performance highlights include: |

| ● | 3-year total revenue Compound Annual Growth Rate (“CAGR”) of 7% |

| ● | 3-year adjusted diluted EPS CAGR of 11% |

| ● | 3-year average organic growth* of +5% |

| ● | 142 years of consecutive dividend payments |

| ● | Approximately 50% of capital deployed to shareholders and 50% to M&A activity over the long term |

| * | Organic growth is defined as total sales growth less the sales of companies acquired and divested in the past 12 months and foreign currency impacts. |

| ** | See Appendix A for a reconciliation of GAAP diluted EPS to adjusted diluted EPS. |

ii

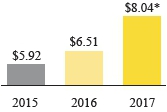

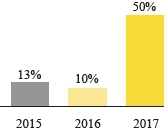

POSITIVE PERFORMANCE RESULTS OVER THE LAST THREE YEARS

| * | See Appendix A for a reconciliation of GAAP diluted EPS to adjusted diluted EPS. |

BOARD SKILLS AND QUALIFICATIONS

The Board is committed to diversity and inclusion on the Board and throughout the Company. Most recently, in July 2018, the Board amended the charter of the Corporate Governance Committee to formally confirm its commitment to the consideration of diversity in the process of identifying director candidates. Our Corporate Governance Committee gives serious consideration to the diverse characteristics of our board members and board nominees, and the pool from which we select board nominees, which characteristics may include gender, race, nationality, age, geographic origin and personal, educational and professional experience and skills.

iii

CORPORATE GOVERNANCE HIGHLIGHTS

The Corporate Governance Committee and the Board of Directors review the Board of Director’s Governance Guidelines for possible revision at least once each year, and otherwise consider whether the Company’s policies and procedures should be modified to reflect changes in governance best practices or regulatory updates. The Company’s governance policies include the following best practices:

●Annual election of directors ●Independent Board, other than our Chief Executive Officer ●Appointment of Independent Chairman ●Shareholder-approved director fee cap ●Proactive adoption of proxy access, allowing eligible long-term shareholders holding 3% or more of our outstanding shares of common stock to include nominations for directors in the Company’s Proxy Statement ●Mandatory director resignation for failure to receive majority vote in uncontested director elections. ●Meeting of independent directors in executive session at every board meeting | ●Policy against hedging or pledging of Company stock applicable to all directors and executive officers ●Recoupment (“clawback”) policy relating to unearned equity and cash incentive compensation of all executive officers ●No shareholder rights (“poison pill”) plan ●Robust stock ownership guidelines for directors and executive officers ●Annual Board and committee self-assessments ●Annual shareholder ratification of independent auditors ●No excise tax gross-ups under change in control agreements with executive officers |

iv

SHAREHOLDER ENGAGEMENT EFFORTS

We place a high priority on regular, year-round proactive engagement with our shareholders to better understand their perspectives about our Company and the market generally. During 2018, we reached out to shareholders representing approximately 43% of our shares outstanding to engage with us on a broad range of corporate governance matters including board composition and structure, risk management, sustainability, innovation and strategy, as well as our executive compensation program.

The feedback we received from shareholders was evaluated by management and shared with the Board and the input we received has enabled us to better understand our shareholders’ priorities and evaluate and improve our governance practices. We continually incorporate shareholder feedback into the review of our governance practices and we have clarified certain disclosures relating to our compensation program, among other matters, as a result of our engagement process. As reflected by the track record of our Say on Pay vote over the past three years, shareholders are generally supportive of our executive compensation programs. In addition, in connection with entering into new change in control agreements with certain named executive officers (“NEOs”) during December 2018, the Compensation Committee made the decision to completely eliminate all excise tax gross-ups from current change in control agreements with executive officers. We are committed to maintaining an open dialogue with our shareholders and a robust engagement program.

v

This summary highlights information regarding voting proposals contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

| Time and Date: | 9:30 a.m., April | ||

| Place: | John F. Lundgren Center for Learning and Development | ||

| 1000 Stanley Drive | |||

| New Britain, Connecticut 06053 | |||

| Record Date: | February | ||

| Voting: | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

Meeting Agenda

| ● | Election of directors |

| ● | Approve |

| ● | Approve selection of Ernst & Young LLP as the registered independent public accounting firm for fiscal |

| ● | Approve the Company’s Global Omnibus Employee Stock Purchase Plan (“ESPP”) |

| ● | Transact other business that may properly come before the meeting or any adjournment or postponement thereof |

Voting Matters and Vote Recommendation

| Proposal No. | Matter | Board Vote Recommendation | Page Reference (for more detail) | Matter | Board Vote Recommendation | Page Reference (for more detail) | ||||||||

| 1 | Election of Directors | FOR EACH NOMINEE | 1 | Election of Directors | FOR EACH NOMINEE | 1 | ||||||||

| 2 | Approve 2018 Omnibus Award Plan | FOR | 53 | Approve Compensation of Named Executive Officers on an Advisory Basis | FOR | 59 | ||||||||

| 3 | Approve Compensation of Named Executive Officers on an Advisory Basis | FOR | 61 | Approve Ernst & Young LLP as the Registered Independent Public Accounting Firm for Fiscal 2019 | FOR | 60 | ||||||||

| 4 | Approve Ernst & Young LLP as the Registered Independent Public Accounting Firm for Fiscal 2018 | FOR | 62 | Approve the Company’s Global Omnibus ESPP | FOR | 61 | ||||||||

(i)vi

Board Nominees

The following table provides summary information about each director nominee (please see “Item 1—Election of Directors” for more information). Under the Company’s Bylaws, becauseand in accordance with the opt-in provisions of the Connecticut Business Corporation Act, a director who receives more “against” than “for” votes in an uncontested election of directors atwill have his or her term as a director end without any further action by the 2018 Annual Meeting is uncontested, if a nominee receives more votes “against” than “for” election, the term of that director will end on the earlier of (1)Board ninety (90) days from the date on whichafter the voting results are determined or (2) the date on whichearlier, if the Board selects ana qualified individual to fill the office held by such director (please see “Voting Information, Vote required for approval” for more information).director’s seat. Each director nominee is currently serving as a director and attended at least 75% of all regularly scheduled and special meetings of the Board and the committees on which he or she served during the director nominee’s tenure.

| Committee Memberships | Committee Memberships | |||||||||||||||||||||||

| Name | Age | Director Since | Occupation | Exec. | Audit | Corporate Governance | Finance & Pension | Comp. & Talent Dev. | Age | Director Since | Occupation | Exec. | Audit | Corporate Governance | Finance & Pension | Comp. & Talent Dev. | ||||||||

| Andrea J. Ayers | 54 | 2014 | President and Chief Executive Officer, Convergys Corporation | 55 | 2014 | Former President and Chief Executive Officer, Convergys Corporation | C | |||||||||||||||||

| George W. Buckley, Chairman | 71 | 2010 | Retired Chairman, President and Chief Executive Officer, 3M Company | C | 72 | 2010 | Retired Chairman, President and Chief Executive Officer, 3M Company | C | ||||||||||||||||

| Patrick D. Campbell | 65 | 2008 | Retired Senior Vice President and Chief Financial Officer, 3M Company | C | 66 | 2008 | Retired Senior Vice President and Chief Financial Officer, 3M Company | C | ||||||||||||||||

| Carlos M. Cardoso | 60 | 2007 | Principal of CMPC Advisors LLC | C | 61 | 2007 | Principal of CMPC Advisors LLC | C | ||||||||||||||||

| Robert B. Coutts | 68 | 2007 | Retired Executive Vice President, Electronic Systems, Lockheed Martin Corporation | 69 | 2007 | Retired Executive Vice President, Electronic Systems, Lockheed Martin Corporation | ||||||||||||||||||

| Debra A. Crew | 47 | 2013 | Former President and Chief Executive Officer, Reynolds American Inc. | 48 | 2013 | Former President and Chief Executive Officer, Reynolds American Inc. | ||||||||||||||||||

| Michael D. Hankin | 60 | 2016 | President and Chief Executive Officer, Brown Advisory Incorporated | 61 | 2016 | President and Chief Executive Officer, Brown Advisory Incorporated | C | |||||||||||||||||

| James M. Loree | 59 | 2016 | President and Chief Executive Officer, Stanley Black & Decker, Inc. | 60 | 2016 | President and Chief Executive | ||||||||||||||||||

| Marianne M. Parrs | 73 | 2008 | Retired Executive Vice President and Chief Financial Officer, International Paper Company | C | ||||||||||||||||||||

| Robert L. Ryan | 74 | 2010 | Retired Senior Vice President and Chief Financial Officer, Medtronic Inc. | C | ||||||||||||||||||||

| James H. Scholefield | 55 | 2017 | Vice President and Global Chief Information Officer, Nike, Inc. | 57 | 2017 | Executive Vice President and Chief Information and Digital Officer, Merck | ||||||||||||||||||

| Dmitri L. Stockton | 55 | 2018 | Retired Chairman, President & | |||||||||||||||||||||

Committee composition is as of the date of this Proxy Statement. Committee memberships are indicated in yellow, with Committee Chairs indicated by a C. All directors, other than Mr. Loree, are independent.

(ii)vii

Corporate Governance HighlightsTable of Contents

The Corporate Governance Committee and the Board of Directors review the Board of Directors Governance Guidelines for possible revision at least once each year, and otherwise consider whether the Company’s policies and procedures should be modified to reflect best practices. The Company’s governance practices include the following best practices:

Stanley Black & Decker 2018 Omnibus Award Plan

The Board has approved, and recommends the Company’s shareholders approve, a new 2018 Omnibus Award Plan (the “2018 Plan”) to replace the Company’s existing 2013 Long-Term Incentive Plan (the “2013 Plan”). The new plan is based on the 2013 Plan and is substantially similar to the 2013 Plan. A summary of the material terms of the 2018 Plan, which also outlines the differences between the 2013 Plan and the 2018 Plan, can be found in “Item 2—Approval of 2018 Omnibus Award Plan”.

Please see “Item 2—Approval of 2018 Omnibus Award Plan” for more information.

Executive Compensation Advisory Vote

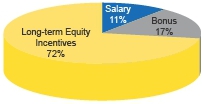

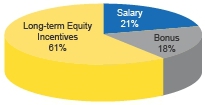

The Board recommends shareholders vote to approve, on an advisory basis, the compensation paid to the Company’s named executive officers as described in this Proxy Statement for the reasons discussed in this Proxy Statement, including:including our commitment to our pay for performance philosophy:

| ● | We follow a pay for performance philosophy, pursuant to which our employees are incentivized to achieve or exceed objective financial goals established for the Company and deliver superior returns to our shareholders. |

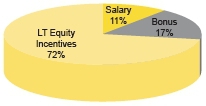

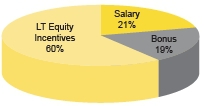

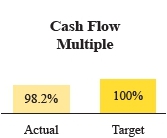

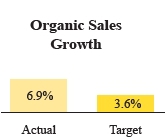

| ● | Our |

| ● | Our long-term performance targets are aggressive, as evidenced by the fact that, over the last five years, none of our long-term incentive programs have paid out at maximum. |

| ● | Our pay for performance alignment is strong, with pay opportunity targeted at the market median and realizable pay over the most |

| ● | In each of the last three years, we received strong shareholder support for our named executive officer compensation |

| ● | Our compensation programs follow executive compensation best practices, |

Please see “Item 3—2—Advisory Vote to Approve Compensation of Named Executive Officers” for more information.

(iii)

Auditors

We ask that the shareholders approve the selection of Ernst & Young LLP as our registered independent public accounting firm for fiscal year 2018.2019. Please see “Item 4—3—Approval of Registered Independent Public Accounting Firm” for more information, including the amount of fees for services provided in 20162017 and 2017.2018.

2019Approval of Global Omnibus ESPP

The Company is seeking shareholder approval of the Stanley Black & Decker, Inc. Global Omnibus ESPP which was recommended for adoption by the Finance and Pension Committee of the Board on October 17, 2018, and adopted by the full Board on October 18, 2018. Please see “Item 4—Approval of Global Omnibus Employee Stock Purchase Plan” for more information.

2020 Annual Meeting

| ● | Shareholder proposals submitted for inclusion in our |

| ● | Notice of shareholder proposals for the |

| ● | Notice with respect to director nominees submitted through proxy access for the 2020 Annual Meeting will not be timely if received at the Company’s principal executive offices before October 8, 2019, or after November 7, 2019. |

Please see “Shareholder Proposals for the 20192020 Annual Meeting” for more information.

(iv)viii

STANLEY BLACK & DECKER, INC.

1000 Stanley Drive

New Britain, Connecticut 06053

Telephone: 860-225-5111

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

March 9, 20186, 2019

To the Shareholders:

The Annual Meeting of Shareholders of Stanley Black & Decker, Inc. (the “Annual Meeting”) will be held at the John F. Lundgren Center for Learning and Development, 1000 Stanley Drive, New Britain, Connecticut 06053 on April 19, 2018,17, 2019, at 9:30 a.m. for the following purposes:

| (1) | To elect the Board of Directors of Stanley Black & Decker,Inc.; |

| (2) |

|

To approve, on an advisory basis, the compensation of the Company’s named executive officers; | |

To approve the selection of Ernst & Young LLP as the Company’s registered independent public accounting firm for the | |

| (4) | To approve the Company’s Global Omnibus Employee Stock Purchase Plan; and |

| (5) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Shareholders of record at the close of business on February 16, 201815, 2019, are entitled to vote at the meeting and any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on April 19, 2018:17, 2019: This Proxy Statement, together with the Form of Proxy and our Annual Report, are available free of charge athttp://www.edocumentview.com/SWK.

| |

Janet M. Link |

STANLEY BLACK & DECKER, INC.

1000 Stanley Drive

New Britain, Connecticut 06053

Telephone: 860-225-5111

PROXY STATEMENT FOR THE APRIL 19, 201817, 2019, ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Stanley Black & Decker, Inc. (the “Company”), a Connecticut corporation, to be voted at the 20182019 Annual Meeting, and any adjournment or postponement thereof (the “Annual Meeting”), to be held on the date, at the time and place, and for the purposes set forth in the foregoing Notice. No business may be transacted at the Annual Meeting other than the business specified in the Notice of the Annual Meeting, business properly brought before the Annual Meeting at the direction of the Board of Directors, and business properly brought before the Annual Meeting by a shareholder who has given notice to the Company’s Secretary that was received after November 8, 20179, 2018, and no later than December 8, 2017.9, 2018. The Company has received no such notice. Management does not know of any matters to be presented at the Annual Meeting other than the matters described in this Proxy Statement. If, however, other business is properly presented at the Annual Meeting, the proxy holders named in the accompanying proxy will vote the proxy in accordance with their best judgment.

This Proxy Statement, the accompanying Notice of the Annual Meeting and the enclosed proxy card are first being mailed to shareholders on or about March 9, 2018.6, 2019.

At the 20182019 Annual Meeting, the shareholders will be asked to elect all of the nominees set forth below to the Board of Directors. Each director, if elected, will serve until the 20192020 Annual Meeting and until the particular director’s successor has been elected and qualified.

The Board of Directors recommends a vote FOR the nominees.If for any reason any nominee should not be a candidate for election at the time of the meeting, the proxies may be voted, at the discretion of those named as proxies, for a substitute nominee.

Information Concerning Nominees for Election as Directors

|  | ANDREA J. AYERS, former President and Chief Executive Officer of Convergys Corporation, has been a director of the Company since December 2014. Ms. Ayers Ms. Ayers is Ms. Ayers had a significant role in the transformation of Convergys from a company with three business lines to a customer management solutions company with approximately 125,000 employees worldwide. She has expertise in multi-channel customer experience, customer management analytics and technology. Ms. Ayers’ experience and expertise provide a valuable resource to the Board and management. |

| |

| GEORGE W. BUCKLEY, retired Chairman, President and Chief Executive Officer of 3M Company, was elected Chairman of the Board effective January 1, 2017, and has been a director of the Company since March 2010. Mr. Buckley also served on the Board of The Black & Decker Corporation from 2006 until 2010. From April 2015 through December 2016, he served as Lead Independent Director of the Board. Mr. Buckley served as Chairman, President and Chief Executive Officer of 3M Company from December 2005 until May 2012. From 1993 to 1997, Mr. Buckley served as the Mr. Buckley As the former Chairman, President and Chief Executive Officer of 3M Company, Mr. Buckley provides the Board with the expertise and knowledge of managing a large, multi-national corporation. This knowledge, combined with his prior experience as the Chief Executive Officer of Brunswick Corporation and his expertise related to technology-driven manufacturing, provides a valuable resource to the Board and management. |

|  | PATRICK D. CAMPBELL, retired Senior Vice President and Chief Financial Officer of 3M Company, has been a director of the Company since October 2008. Mr. Campbell served as Senior Vice President and Chief Financial Officer of 3M Company from 2002 to 2011. Prior to his tenure with 3M, Mr. Campbell had been Vice President of International and Europe for General Motors Corporation where he served in various Mr. Campbell is As the former Senior Vice President and Chief Financial Officer of 3M Company, Mr. Campbell has expert knowledge in finance. Before he joined 3M Company, Mr. Campbell worked at General Motors in various capacities, including the role of Chief Financial Officer and Vice President of General Motors International Operations, based in Switzerland, for five years. This experience gives Mr. Campbell a perspective that he is able to use to help the Board understand the issues management confronts on a daily basis and to serve as a valuable resource for the Board and management. |

| |

| CARLOS M. CARDOSO, Principal of CMPC Advisors LLC, has been a director of the Company since October 2007. Mr. Cardoso joined CMPC Advisors LLC in January 2015. Prior to that, he served as Chairman of Kennametal, Inc. from January 2008 until December 2014 and as President and Chief Executive Officer of Kennametal from January 2006 until December 2014. Mr. Cardoso joined Kennametal in 2003 and served as Vice President, Metalworking Solutions and Services Group and then as Executive Vice President and Chief Operating Officer before he became President and Chief Executive Officer. Prior to his tenure with Kennametal, Mr. Cardoso was President of the Pump Division of Flowserve Corporation from 2001 to 2003. Mr. Cardoso is currently Chairman of the Board of Directors for Garrett Motion Inc., and also serves as a director of Hubbell Incorporated. Mr. Cardoso is As Chairman of the Board, President and Chief Executive Officer of Kennametal, Inc., Mr. Cardoso faced the challenge of managing a complex company on a daily basis. This experience, combined with the skills Mr. Cardoso acquired in his leadership roles at Kennametal, Inc. and Flowserve Corporation, make him a valuable resource for the Board and management. |

| |

| ROBERT B. COUTTS, retired Executive Vice President, Electronic Systems of Lockheed Martin Corporation, has been a director of the Company since July 2007. Mr. Coutts served as an Executive Vice President of Lockheed Martin Corporation from 1999 through 2008, first as Executive Vice President, Systems Integration from 1999 to 2003, and then as Executive Vice President, Electronic Systems from 2003 to 2008. While at Lockheed Martin, Mr. Coutts also served as Chairman of Sandia National Laboratories. Prior to his tenure with Lockheed Martin, Mr. Coutts held senior management positions over a 20-year period with the General Electric Company. In addition, he is a director of Hovnanian Enterprises, Inc., and of Siemens Government Technologies, Inc. Within the past five years, Mr. Coutts has served on the board of Pall Corporation. Mr. Coutts is Mr. Coutts’ long experience in senior management of Lockheed Martin and General Electric Company has led him to develop expertise in manufacturing, program management, supply chain management, technology and government contracting that is of value to the Board as the Company continues to improve its global manufacturing operations and sourcing. He also has cyber technology experience through many of the contracts he managed for and with the United States |

|  | DEBRA A. CREW, former President and Chief Executive Officer, Reynolds American Inc., has been a director of the Company since December 2013. Ms. Crew served as President and Chief Executive Officer of Reynolds American Inc. from January Ms. Crew is Ms. Crew brings to the Board an impressive record of success with leading global consumer products companies as well as a broad range of experience in marketing, operations and strategy. Ms. Crew’s global perspective, combined with proven commercial capabilities and exposure to world-class innovation planning processes, |

| |

| MICHAEL D. HANKIN, President and Chief Executive Officer, Brown Advisory Incorporated, has been a director of the Company since April 2016. Mr. Hankin has served as Chief Executive Officer of Brown Advisory Incorporated since 1998, when the firm was acquired from During Mr. Hankin’s tenure as Chief Executive Officer of Brown Advisory Incorporated, the firm has grown from a company with approximately $1.5 billion in client assets to a company with over Mr. Hankin is Mr. Hankin’s experience building and running a successful, complex and diverse global financial company, his familiarity with financial and investment planning and analysis, his understanding of capital structure and valuation issues, and his experience with cybersecurity make him a valuable resource for the Board and management. |

|  | JAMES M. LOREE, President and Chief Executive Officer of the Company, has been a director of the Company since July 2016. Mr. Loree joined the Company in July 1999 as Vice President, Finance and Chief Financial Officer. He was named Executive Vice President and Chief Financial Officer in September 2002, Executive Vice President and Chief Operating Officer in January 2009, President and Chief Operating Officer in January 2013, and President and Chief Executive Officer of the Company in July 2016. Before he joined the Company, Mr. Loree held positions of increasing responsibility in financial and operating management in industrial businesses, corporate and financial services at General Electric from 1980 to 1999. Mr. Loree served on the board of Harsco Corporation from 2010 to 2016 and as Chair of Harsco’s Audit Committee for three years during that period. Mr. Loree currently serves on the board of Whirlpool Corporation. Mr. Loree is As the Chief Executive Officer of the Company, Mr. Loree provides the Board with knowledge of the daily workings of the Company and also with the essential experience and expertise that can be provided only by a person who is intimately involved in running the Company. Mr. Loree’s service on the Board and as Chief Executive Officer of the Company provides seamless continuity of leadership for the Board and management. |

| ||

|

|

|

|

|

Currently, Mr. Scholefield As the Global Chief Information Officer of NIKE, Inc., Mr. Scholefield

|

5

| DMITRI L. STOCKTON, former Chairman, President & Chief Executive Officer of GE Asset Management, has been a director of the Company since July 2018. Mr. Stockton was previously with GE Asset Management, a global asset management firm with nearly $120 billion in assets under management focused on private equity, real estate, fixed income, active equities and hedge fund investing. He retired from GE after the successful sale of GE Asset Management to State Street. Mr. Stockton spent a total of 30 years with GE and was one of approximately 20 Corporate Senior Vice Presidents that served on the Company’s Corporate Executive Council. During his tenure, he lived and worked abroad for a decade of his career in three different countries. He led businesses across 26 global markets with approximately 40,000 employees in his final assignment internationally. Mr. Stockton earned a bachelor’s degree in Accounting from North Carolina Agricultural and Technical State University, and currently serves as a director on the boards of Deere & Company, Ryder Systems Inc., and Target Corporation. Mr. Stockton is 55 years old and is a member of the Audit Committee and the Corporate Governance Committee. Mr. Stockton’s global experience, his familiarity with financial planning and analysis, real estate and investment strategy, as well as his understanding of capital structures, make him a valuable resource for the Board and management. |

Nomination Process.All candidates for Board membership are evaluated by the Corporate Governance Committee. In evaluating candidates, including existing Board members, the Corporate Governance Committee considers an individual candidate’s personal and professional responsibilities and experiences, the then-current composition of the Board, the diversity of the then-current board and the challenges and needs of the Company in an effort to ensure that the Board, at any time, is comprised of a diverse group of members who, individually and collectively, best serve the needs of the Company and its stockholders.shareholders. The Corporate Governance Committee may also consider recommendations from third-party search firms, whose function is to assist in identifying qualified candidates. In general, and in giving due consideration to the composition of the Board at the time a candidate is being considered, the desired attributes of individual directors are:Corporate Governance Committee considers a potential nominee or director’s:

| ● | integrity and demonstrated high ethical standards; |

| ● | experience with business administration processes and principles; |

| ● | |

| ● | knowledge, experience, and skills in |

| ● | |

| ● | willingness and ability to work with other members of the Board in an open and constructive manner; |

| ● | |

| ● | diversity with respect to other characteristics, which may include, |

Shareholder Nomination Process.Shareholders who wish to submit names to be considered by the Corporate Governance Committee for nomination for election to the Board of Directors may do so by contacting us through the Corporate Secretary, Stanley Black & Decker, 1000 Stanley Drive, New Britain, CT 06053 and should submit the following information:

| (i) | the name and record address of the shareholder of record making such nomination and any other person on whose behalf the nomination is being made, and of the person or persons to be nominated, |

| (ii) | the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such shareholder or such other person, |

| (iii) | a description of all arrangements or understandings between such shareholder and any such other person or persons or any nominee or nominees in connection with the nomination by such shareholder, |

| (iv) | such other information regarding each nominee proposed by such shareholder as would be required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required to be disclosed, pursuant to the rules of the Securities and Exchange Commission had the nominee been nominated or intended to be nominated by the Board of Directors, and shall include a consent signed by each such nominee to be named in the Proxy Statement for the Annual Meeting as a nominee and to serve as a director of the Company if so elected, |

| (v) | a representation that such shareholder intends to appear in person or by proxy at the Annual Meeting to make such nomination, |

| (vi) | a duly executed representation that, if elected as a director of the Company, the proposed nominee shall comply with the Company’s Code of Business Ethics and Board of Director’s Governance Guidelines in all respects, share ownership and trading policies and guidelines and any other Company policies and guidelines applicable to directors, as well as any applicable law, rule or regulation or listing requirement, and |

| (vii) | a completed and duly executed written questionnaire with respect to the background of the nominating shareholder and any other person or entity on whose behalf, directly or indirectly, the nomination is being made (which questionnaire shall be provided by the Secretary upon written request). |

Shareholders wishing to nominate a director should follow the specific procedures set forth in the Company’s Bylaws.

Proxy Access.In July 2018, our Board amended the Company’s Bylaws to permit a shareholder, or a group of up to 20 shareholders, owning 3% or more of the outstanding common stock of the Company continuously for at least three years, to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the shareholder(s) and the nominee(s) satisfy the requirements specified in Article II, Section 6, of the Company’s Bylaws. Under that Section, the required notice must be received at the Company’s principal executive offices, subject to certain exceptions, at least 120 days but no more than 150 days prior to the anniversary of the date on which the Proxy Statement was first mailed relating to the immediately preceding Annual Meeting.

Qualifications of Directors and Nominees.The Board is committed to maintaining a diverse and well-rounded membership, complete with qualifications, skills and experience that support not only the Company’s business needs, but that also provide a fresh, holistic approach to the Company’s business model as a whole. Over the years, the Board has developed a deep and varied skill set, with a membership that reflects a comprehensive spectrum of both professional and personal experiences. The Board continues to focus its efforts on identifying candidates for nomination that add to, or otherwise complement, the skills and qualifications of its existing members.

The CompanyBoard is committed to diversity and inclusion at the Board level and throughout the Company. In July 2018, the Board amended the charter of the Corporate Governance Committee to formally confirm its commitment to the consideration of diversity in the process of identifying director candidates. Specifically, the charter provides that members of the Corporate Governance Committee will take reasonable steps to include diverse candidates with respect to gender, ethnicity, race, nationality, age, skills and experience in the context of the needs of the Board in the pool of potential candidates under consideration.

The Corporate Governance Committee and the Board carefully considered the qualifications, skills and experience of each nominee when concluding that this year’s nominees should serve on the Board. With respect to each individual nominee, the Company believes that the nominee is appropriate to serve on the Board due to the qualifications and experience described next to their profile above. The Company believes that each of the incumbent directors should be reelected, as their qualifications, skills and experience continue to be of value to the Company.

The chart below highlights certain of the diverse sets of skills, knowledge, background and experience that the Company believes is reflectiveare represented on our Board:

|  |  |  |  |  |  |  |  |  | |

| Skills and Experience | ||||||||||

| Active Executiveexperience provides current insight into the best practices and challenges of leading a complex organization. | X | X | X | |||||||

| CEO experienceprovides insight into leading a complex organization like ours with transparency and integrity. | X | X | X | X | X | X | X | |||

| Public Company/Corporate Governancefurthers our goals of transparency, protection of shareholder interests and implementation of best practices in corporate governance. | X | X | X | X | X | X | X | X | X | X |

| Corporate Social Responsibilityexperience is important in managing risk and furthering long-term value creation for shareholders by operating in a sustainable and responsible manner. | X | X | X | X | ||||||

| Digitalexperience is relevant to understanding and evaluating the Company’s efforts in areas such as e-commerce and data and analytics. | X | X | X | |||||||

| Finance/Capital Allocationexperience enables effective monitoring of the Company’s financial reporting and control environment, assessment of its financial performance, oversight of mergers and acquisitions, and ensuring appropriate shareholder return. | X | X | X | X | X | X | X | |||

| Legal/Regulatory/Government Affairsexperience enhances understanding of legal matters and public policy issues. | X | X | ||||||||

| Human Capitalexperience is relevant to effective review of our efforts to recruit, retain and develop top talent. | X | X | X | X | X | X | X | X | X | |

| Product Developmentexperience provides insight into ideation, research and development, and commercialization of products and services. | X | X | X | X | X | |||||

| Manufacturing/Logistics/Supply Chainexperience enhances the Board’s ability to oversee cost-effective, technology-driven manufacturing and logistics processes. | X | X | X | X | X | |||||

| Global Operationsexperience facilitates assessment of the Company’s complex, international operations. | X | X | X | X | X | X | X | X | X | X |

| M&A and Corporate Strategyexperience provides insight into assessing M&A opportunities for a strategic fit, strong value creation potential and clear execution capacity. | X | X | X | X | X | X | X | X | X | |

| Risk Managementexperience is important to the identification and mitigation of significant risks. | X | X | X | X | X | X | X | X | X | |

| Innovation/Technology/Cybersecurityexperience enhances the Board’s ability to appraise our progress in executing the strategy of becoming known as one of the world’s leading innovators. | X | X | X | X | X | X | X | X | X | |

| Sales/Marketing/Brand Managementexperience provides insights into the sales and marketing process and increasing the perceived value of our brands in the marketplace. | X | X |

Table of the attributes and values that the Board finds desirous in its candidates:

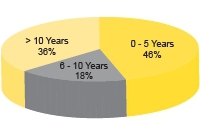

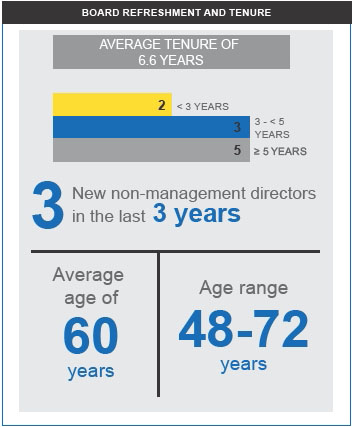

BoardDirector Tenure and Age and Board Refreshment.The tenure of our Board members ranges from less than a year to more than 10 years, with almost half of the members joining the Board within the last five years, as reflected below*:years. Our Board members reflect a wide age range, providing a range of experience and expertise. See more information below:*

Tenure

* | Data includes years of service on the Board of The Black & Decker Corporation for |

Board Leadership Structure.Effective January 1, 2017, the Company separatedeliminated the officesposition of ChairmanLead Independent Director and Chief Executive Officer, withappointed George W. Buckley, a non-management Director servingdirector, as Chairman. Under the terms of the Company’s Bylaws and Corporate Governance Guidelines, the Chairman presides at all meetings of the Board at which he is present and, jointly with the Chief Executive Officer, establishes a schedule of agenda subjects to be discussed during the year at the beginning of each year and the agenda for each Board meeting. If the Chairman is not present, the Directorsdirectors present will designate a person to preside.

Risk Oversight.Stock Ownership Policy for Non-Employee Directors and Executive Officers.As required by our Corporate Governance Guidelines, duringThe Company’s Bylaws require directors to be shareholders. The Board maintains a Stock Ownership Policy for Non-Employee Directors, a copy of which can be found on the orientation process for new directors, each director receives a presentation from“Corporate Governance” section of the Company’s senior managementwebsite atwww.stanleyblackanddecker.com (which appears under the “Investors” heading). Pursuant to that detailspolicy, non-employee directors are required to acquire shares having a value equal to 500% of the Company’s risk management policiesannual cash retainer within five years of becoming a director, and procedures. Our Audit Committee routinely discussesare expected to maintain such ownership level during their tenure in accordance with management the Company’s major financial risk exposures andpolicy. Directors are expected to defer their fees in the steps management has taken to monitor and control such exposures, includingform of Company common stock until they have met this requirement. For more information about the Company’s risk assessment and risk management policies. In addition,stock ownership policy for executive officers, please see the full Board reviews the Company’s risk management program and its adequacy to safeguard the Company against extraordinary liabilities or losses on at least an annual basis. The Board is committed to having individuals experienced in risk management on the Audit Committee, as well as on the full Board.“Executive Officer Stock Ownership Policy” section of this Proxy Statement.

Meetings.Meetings. The Board of Directors met sixeight times during 2017.2018. The Board’s standing committees met the number of times shown below:

| Committee | Number of Meetings | |

| Executive | ||

| Audit | 4 | |

| Corporate Governance | 4 | |

| Finance and Pension | 3 | |

| Compensation and Talent Development |

The members of the Board serve on the committees described in their biographical material on pages 2-62-5 (see also the summary chart on page (ii))vii). In 2017, each2018, no incumbent director attended at leastfewer than 75% of the aggregate of the total number of meetingsboard of the Board of Directorsdirector meetings and committees of the Board of Directors on which suchthe incumbent director served that have been held since the director became a member of the Board or the applicable committees.served. Although the Company has no formal policy regarding attendance by members of the Board of Directors at the Company’s Annual Meetings, all but one of the then-serving members of the Board of Directors attended the 20172018 Annual Meeting.

Director Independence.Independence. The Board of Directors has adopted Director Independence StandardsGuidelines which are available free of charge on the “Corporate Governance” section of the Company’s website (which appears under the “Investors” heading) atwww.stanleyblackanddecker.com. The Board of Directors has made the determination that all directorDirector nominees standing for election, except Mr. Loree, are independent according to the Director Independence Standards, the applicable rules and regulations of the Securities and Exchange Commission, and as independence is defined in Section 303A of the New York Stock Exchange listing standards. It is the policy of the Board of Directors that every member of the Audit, Corporate Governance, and Compensation and Talent Development and Finance and Pension Committees should be an independent director. The charters of each of these committees and the Board of Directors Corporate Governance Guidelines are available free of charge on the “Corporate Governance” section of the Company’s website atwww.stanleyblackanddecker.com (which appears under the “Investors” heading) or upon written request to Stanley Black & Decker, Inc., 1000 Stanley Drive, New Britain, Connecticut 06053, Attention: Investor Relations. Changes to any committee charter, the Director Independence Standards or the Corporate Governance Guidelines will be reflected on the Company’s website.

Executive Committee.Table of ContentsThe Executive Committee exercises all

Our Board administers its strategic planning and risk oversight function as a whole and through its Board committees.The following describes the powersrole of theour Board of Directors during intervals between meetings of the Board; however, the Executive Committee does not have the power to declare dividends or to take actions reserved by law to the Board of Directors. The Executive Committee operates under a charter, which is available free of charge on the “Corporate Governance” section of the Company’s website atwww.stanleyblackanddecker.com.committees: